Strap in folks.

John Malone, who holds most of Discovery’s voting rights is at it again. In January 1990 he had ‘tight control’ over the media industry. So in order to alleviate some pressure from Washington, he decided to spin-off the telecom giants programming assets from its cable operations, and he made a quick fortune in doing so. The scene has changed and cable is no longer the king of content, but behind John Malone’s leathery exterior sits a keen mind that is ever aware of the changing landscape- and how to profit from it.

Spin-offs

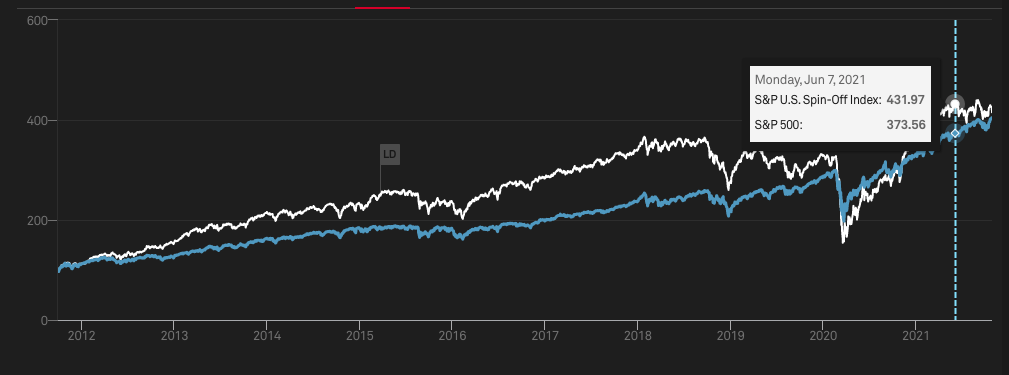

Funnily enough, where there is proof that acquisitions destroy shareholder value there is also proof that spin-offs tend to add value. Spin-offs give the market the opportunity to appraise a single segment or division of a company, rather than looking at it boxed up with old antiques.

Below, the white graph shows the S&P U.S. Spin-Off index compared to the blue- S&P500.

This doesn’t mean we can blindly jump into a spin-off. We still need to do our homework.

Looking into AT&T previously naturally led me to take a squiz at Discovery again. The spin-off merger (planned to happen next year, 2022) of WarnerMedia from AT&T into Discovery is a big deal. WarnerMedia has top content, HBO Max is set to compete on the global stage with Netflix, Disney+ Apple TV, and Amazon Prime and Discovery is the bridge for the expansion.

I feel like I am slightly late to the game on this one, as most of the internet has already pored over this. But from what I have seen (or what I have missed) they didn’t get the value quite right.

I looked briefly at Discovery some years ago, the share price was depressed then too. A large amount of debt and cable assets didn’t scream “buy” to me. Their shares could also easily be diluted by preferred stock shareholders. Netflix was also gobbling up subscribers who were slowly cutting their cable.

Maybe Discovery has passed its prime, maybe the days of watching Bear Grylls drink his own piss are gone…or are they?

Discovery:

Discovery isn’t an overly complicated business. They do television networks and make content. Their money comes from advertising and distribution.

Discovery’s biggest moneymaker is their American television network segment. But they also have a great footprint internationally. The television network segment which contains Discovery Channel, Food Network, and others, has a significant amount of subscribers.

Discovery 2019:

Cash provided by operations: +3.4Bn

Cash used in investing: -438Mn

Free cash flow to the firm: ~3Bn

Discovery 2020: Covid Year

Cash provided by operations: +2.7Bn

Cash used in investing: -703Mn

Free cash flow to the firm: ~2Bn

Strong Cash Flow

Discovery has a strong cash flow. Most of the 3bn and 2bn generated in 2019 and 2020 respectively have been used to buy back stock and pay down debt. Debt sits at ~15Bn, so they are not conservatively leveraged but Discovery easily covers this ~$650Mn interest expense so it’s not a dangerous amount of debt either.

A nice way to scan a company before diving into the dirty details is to look at the cash flow generated and compare that to its market capitalization. This gives you a rough free cash flow yield. I like to take their cash flow and cut a good 10-30% off of it, so I arrive at a conservative estimate. Then if the cash flow yield is still above 10-15% I start looking deeper. I do this to maintain a margin of safety, it gives me room to make mistakes because I am not omniscient.

Looking at Discovery itself, however, is not the way to value this business. The merger is going to change what Discovery shareholders are exposed to.

In 2022, Discovery shareholders are going to hold much less of Discovery’s original business. They will be more exposed to Warner Media’s growing business, compared to Discovery’s lackluster television networks business. This changes the game a bit.

If we buy Discovery, we need to understand how much of the pie we’re getting, and at what price…

The Merger

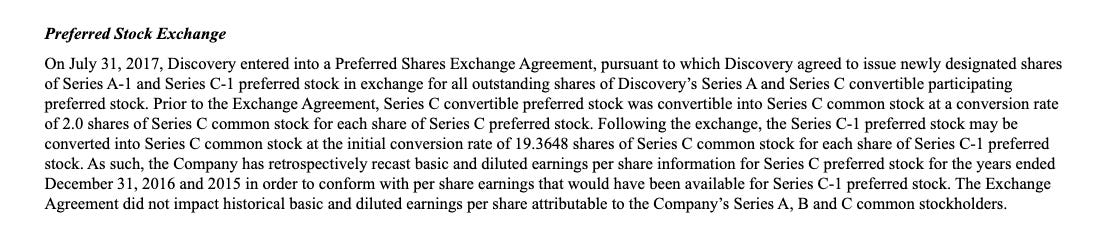

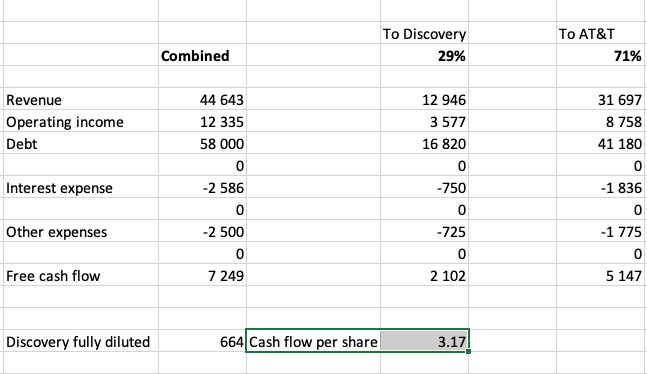

Discovery current has a weighted average of 504Mn undiluted and 664Mn fully diluted shares outstanding. The dilution comes from convertible preference shares, namely Series A and Series C convertible preference shares. “Series A Preferred” originally converts into 9 Series A Common. “Series C Preferred” originally converts into 19 Series C common.

What has changed due to the merger? Here in the Discovery/Warner Media merger agreement or “The Merger Agreement” they provide us with a lovely riddle:

“What are they saying?” right?

We do not need to calculate how much dilution will take place, or what these shares will be converted into. We already know what we need to know- that all the preferred stock is going to convert leading to a full dilution. And the amount of fully diluted shares is given to us on the financial statements - 664Mn.

Valuation

I wouldn’t buy Discovery if in one year’s time it was still going to be Discovery. They have quite a bit of debt, and even though the cash flow yield is ok, I think their business is going to face extreme competition from the streamers.

But, the merger changes a lot of things:

It allows Discovery to help give HBO/HBO Max the international footprint it needs to continue to grow and take on Netflix/Disney.

It gives Discovery shareholders great exposure to a new hot asset, that can turn the 14.6% cash flow yield into a cash flow yield that grows over time which changes Discovery’s valuation completely.

It creates a new streaming media company with tons of hours of content/entertainment AND a way to get it directly to consumers. It allows Discovery to move from earning money from distributors and allowing them to have a direct-to-consumer relationship with customers- huge.

To value Discovery right now, you cannot look at Discovery alone. After the merge Discovery shareholders are going to be holding an entirely different beast. They will have exposure to Warner Bros content, Turner, HBO as well as exposure to the synergies.

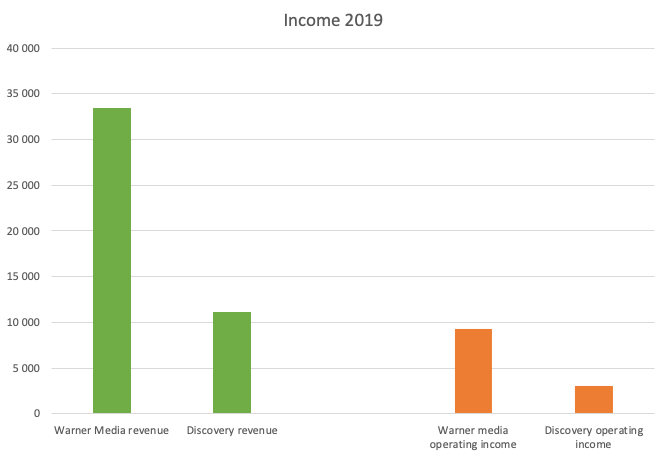

Recall that the new Combined company is going to receive ~75% of its revenue from Warner Media assets.

So what do you get when you buy Discovery common stock now? Below I combined a few metrics from Warner Media and Discovery to create a rough view of the “Combined” company.

If you buy Discovery common stock now, then after the merger you will be receiving ~$3.17 cash flow per share (conservative estimate) that is generated mostly by Warner Media. Discovery is trading lower and lower, around ~$23 per share or a 13.8% cash flow yield or a price to cash flow of 7.25 - using the combined company’s metrics (note: not pre-merger Discovery metrics, these are based on post-merger financials).

But by buying Discovery now, you set yourself up to receive this exposure next year.

Netflix

Compare this to Netflix which has a price to cash flow of ~127. (can’t make this up).

These are pricy multiples because Netflix is growing fast, and has amassed a large market share. The thing is, people do not pay for Netflix, they pay for Netflix’s content, and Warner Media + Discovery will have tons of content. A formidable opponent to Netflix. HBO is already well known globally for Game of Thrones, Succession, and others.

Discovery & Warner merger: Price to cash flow: 7.25

Netflix: Price to cash flow: 127

“You can’t compare Netflix to Warner Media/Discovery” - what better asset is there? Look at HBO Max’s platform compared to Netflix’s below: The similarities are striking, the only difference is the management of the content. Discovery generates income from advertising and distributors whereas Netflix has a direct-to-consumer relationship.

Discovery will provide the bridge to HBO to go global, and HBO can allow Discovery’s content to get closer to a direct-to-consumer model.

The Discovery and Warner Media merger seems like a great “plug and play” way to increase value by moving Discovery’s content away from cable and to an OTT (over the top) service.

Catalyst

Normally I don’t care for a catalyst. I just care for value, but the catalyst here will be the spin-off merger combined with HBO Max going global.

Warning: In a spin-off stocks sometimes tank hard and fast because shareholders from parent companies sell the stock indiscriminately. Some tracker ETF’s may also sell spin-offs because it doesn’t meet the requirements for what they can hold. All of this can add undue pressure in a sell-off. However, in this chaotic environment, it can also offer someone who is prepared to buy at lovely prices.

Disclaimer:

This is purely educational material and it should not be taken as financial advice.