AT&T's Succession

Featuring John Stanky

AT&T (T) and Discovery Inc (DISCK) have both been slowly creeping into value land. So decided to take a look, which turned into quite a thorough examination of the two companies. I am ecstatic to be back!

AT&T plans to spinoff its Warner Media assets into a merger with Discovery next year in 2022. Spin-offs in general have the potential to create opportunities in the stock market when holders of the parent company sell-off the spin-off, but AT&T’s spin-off of WarnerMedia is something special. WarnerMedia will spin-off and merge into Discovery Inc. AT&T shareholders will hold 71% of the new company and Discovery shareholders will own 29% of the new company.

With AT&T and Discovery both reaching for new lows, they both warrant a checkup. I want to see how best to play this, and where the most value lies.

TL;DR (too long didn’t read)

I go into quite a bit of depth below, so here is a breakdown for those who only want a breakdown.

AT&T heading to 2008 lows.

AT&T John Stanky owns is exposed to a lot of the stock

AT&T is currently worth $180Bn.

AT&T Standalone should be worth at least $130Bn after the reduction of debt from the spin-off of WarnerMedia. This is a conservative estimate that takes into account interest reduction from debt payoff (after spin-off) and Entertainment/Business Wireline segments declining prospects.

Warner Media should be worth more than $80Bn (What AT&T originally paid for it in 2018). Comparing Netflix and HBO/HBO Max gives HBO/HBO Max a valuation of $83Bn by itself using a (Revenue/Market cap) multiple of 9.5.

HBO Max’s service/platform is basically identical to Netflix’s. But the content is vastly different, so they don’t really directly compete and can co-exist.

This $83Bn valuation excludes Warner Bros and Turner which are included in the Warner Media segment and will be part of the spin-off, so it’s ultra-conservative. Warner Bros owns so much well-known content, and Turner generates decent operating income ($5Bn).

Warner Media should be worth at least ~$100Bn. AT&T will only own 71% of spin-off

$100Bn(0.71) + 130Bn = $200Bn. AT&T current market cap = $180Bn…Not a HUGE discrepancy, but it’s undervalued using extremely conservative estimates.

I would like to see AT&T trade a little cheaper to increase my margin of safety before I add a concentrated position.

Through my analysis, I was led to Discovery. Discovery will own 29% of the NewCo after the merger. If Warner Media is worth $100Bn, then 29% is worth $29Bn. Discovery is currently trading at $12.44Bn. Now there looks to be a margin of safety worth investing in, especially because I want the upside that HBO Max will offer.

I have already started looking into Discovery and will post on it when I understand it properly.

Starting with AT&T

AT&T is a telecommunications conglomerate. They offer high-speed internet (fiber), mobility solutions, and in 2018 they completed the acquisition of Warner Media for $85Bn in a stock/cash acquisition. Telecommunications companies entering the media industry are not unheard of, but shareholders have been quite unhappy with how much money former CEO Randall Stephenson had spent on acquiring different companies always boasting “Synergies” that amounted to nothing. It is well known that acquisitions on a whole, do not create value.

AT&T trades at $180bn. If we assume that their Warner Media assets are still worth $85bn (conservative estimate). Then AT&T should be worth around $95Bn~ as a standalone telecoms company according to Mr. Market.

Looking at AT&T and WarnerMedia as a standalone company is a good place to start:

As you can see, Communications (telecoms) is the bulk of AT&T’s business. But, what’s it worth?

We need to take a closer look at the Communications and WarnerMedia segments. The other two are insignificant.

Communications:

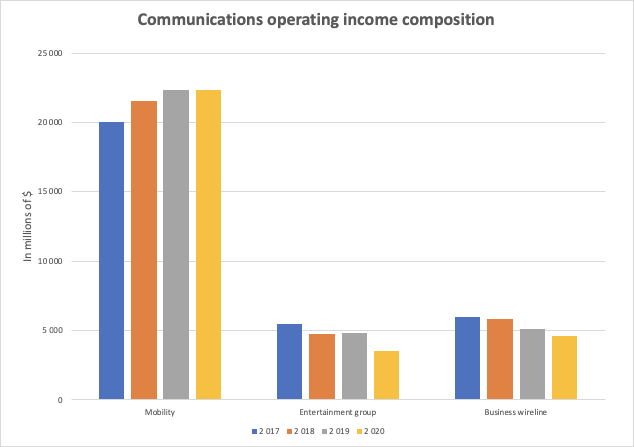

AT&T’s Communications segment consists of 3 moneymakers:

Mobility - wireless service and equipment.

Entertainment group - a cluster that consists of (Video, High-speed internet, Voice and data services, and ‘other’). A struggling segment except for the internet.

Business Wireline - strategic managed services (VPNs, cloud services) and voice & data).

Mobility is growing and has future positive earnings potential. Entertainment Group and Business Wireline include old services that are being mostly displaced by competitors online (Netflix, VOIP providers, etc).

A closer look inside Entertainment Group and Business Wireline shows that High-speed-Internet and Strategic data services are included inside these two segments. High-speed internet and Strategic data services are growing and have strong earnings power so we can factor them into a conservative estimate for what the communications segment should be earning in the future…

Conservative operating contribution:

Mobility: $22Bn

Entertainment: $2Bn (Now earning ~$3.5Bn but trending downwards due to competition- I have given it a bottom of $2Bn because high-speed internet or fiber provides support to this segment)

Business Wireline: $2Bn (Now earning ~$4.5Bn but trending down due to competition in Cloud, VOIP, etc. I have also given it a bottom of $2Bn because high-speed internet and VPNs are provided in this segment which is growing).

Communications: ~$26Bn Operating income (Conservative).

AT&T Standalone:

As a standalone company, AT&T will have around ~$26Bn in operating income. They plan to use ~$40Bn to de-lever their balance sheet (pay down debt) which leaves them with ~$140Bn in total debt. Their current average interest rate is 4.4%. If they have smart-cookie accountants they can lower that rate with the $40Bn debt repayment, but we like to be conservative so we will keep it at 4.4% for our estimates:

Debt: ~$140Bn

Annual interest after de-lever: $140Bn*4.4% = ~$6.150Bn

Operating income after interest = $26bn - $6.150 = $19.85Bn

Operating income after tax = $19.85Bn X 0.71- (0.71 is just 1 minus tax rate).

Operating income after tax = $14.1Bn

I don’t want to use this $14.1Bn when I discount the future cash flows to gauge the intrinsic value of AT&T as a standalone company because it’s too generous. There will be “extra” corporate expenses, restructuring, and miscellaneous expenses that are forever present. Also, there is a non-controlling interest that takes ~$350mn annually.

So let’s call it $11Bn (just to be safe).

I discount these cash flows, again being conservative, at a 10% rate. Assuming no growth for the next 10 years and only 3% growth after that.

Terminal/Intrinsic value = ~$130Bn as a standalone company. Recall now, the market capitalization for AT&T currently is at $180Bn. This means that WarnerMedia is valued at less than what they bought it for. (They bought it for ~$80Bn). I think WarnerMedia should be worth more, look at Netflix/Disney and other streaming services. They are hot shit right now.

It seems like AT&T and WarnerMedia are a little undervalued, even when we use our conservative estimates. But that doesn’t mean AT&T is the best way to play this, there is the spin-off and there is also Discovery Inc. Remember, Discovery will receive 29% of the new company after the spin-off.

Warner Media

Keep in mind the $26Bn operating income from the Communications segment. We are trying to do a conservative sum-of-parts analysis so we can find out what each business should be worth now and after the spin-off.

WarnerMedia consists of 3 main segments:

Turner - owns television networks and makes money from advertising subscription

Home Box Office (HBO) - Owns content and makes money from licensing out content and subscription (think HBO max)

Warner Bros - Has a vast library of content, produces, distributes, and licenses content.

WarnerMedia as a segment has been providing more operating income to AT&T but it isn’t being valued as a media company by the market. The spin-off will allow the market (or a takeover candidate) to adequately value WarnerMedia as a standalone media company.

2020 showed a dip in HBO because of the pandemic. HBO Max launched in May 2020. HBO has been extremely successful and will compete directly with Netflix and Disney +

WarnerMedia: ~ $8bn in operating income and growing

HBO Max is an exciting platform. If you want exposure to a Netflix/Disney + like platform, but aren’t willing to pay those multiples then AT&T or Discovery Inc- after the merger may be the best opportunity for an entry.

The best way to value WarnerMedia would be to try and understand the hidden value in the content of WarnerBros, the hidden value in HBO Max, and the not-so-hidden value in Turner.

HBO & HBO Max

Let’s begin with HBO Max because it’s more exciting, and let’s compare it to Netflix:

Netflix currently has an average paid membership price of ~$13 per month and 209 million subscribers. Revenue of ~$29Bn annually. They currently trade at ~$280Bn in market cap.

HBO and HBO max have an end of the year estimated subscriber base of 70-73 million. Let’s be conservative and use the 70 million. The average cost of $10 per month gives us a revenue of $8.76Bn

Netflix’s market cap to revenue (280Bn/29Bn) = 9.5 multiple.

For HBO to have an equivalent multiple of 9.5 HBO would need to be valued at…

Market Cap/8.76 = 9.5

Therefore Market Cap = $83Bn. Interesting number…that’s what AT&T paid for Warner Media…

Obviously, we cannot directly compare Netflix to HBO Max, Netflix had the first starter advantage and is different in other ways. But it’s a good place to start.

If HBO Max is worth $83Bn then Warner Bros, and Turner come free with the stock. Turner brought in ~5Bn in operating income last year.

This HBOMax back-of-the-envelope calculation does not even include the two biggest contributors to Warner Media: Turner and Warner Bros.

Recap: Where are we at? $130Bn Conservative Standalone- AT&T

AT&T Standalone: $11Bn after tax, interest, depreciation (which could be a CAPEX alternative), and other expenses we may not be accounted for.

The intrinsic value of an $11Bn cash flow, that doesn’t grow for 10 years (conservative), discounted at 10% is worth ~$130Bn.

This must mean that the market thinks AT&T is worth less than $130Bn, or Warner Media is worth less than what AT&T paid for it- even after massive HBO max growth! or… that this stock is undervalued.

I would say the stock is undervalued. If HBO is worth $83Bn, and Netflix is able to accumulate 209 million subscribers, why wouldn’t HBO be able to acquire the same amount of subscribers? The services can co-exist because they are not that expensive and they offer vastly different content.

Now we must not forget, AT&T shareholders will own 71% of the spin-off. The balance (29%) will be owned by Discovery shareholders.

This leads me to Discovery

Discovery

Discovery will receive 29% of NewCo. If WarnerMedia is only worth $80Bn (so conservative) Then Discovery shareholders get 29% $80Bn dollar company? = $23Bn. Disovery’s Market cap is now only $12.44Bn that’s almost a 100% upside.

Time to look into Discovery…The addition of debt from the merger may change the valuation, so it requires further investigation. I will do a write-up of Discovery starting right now.